Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

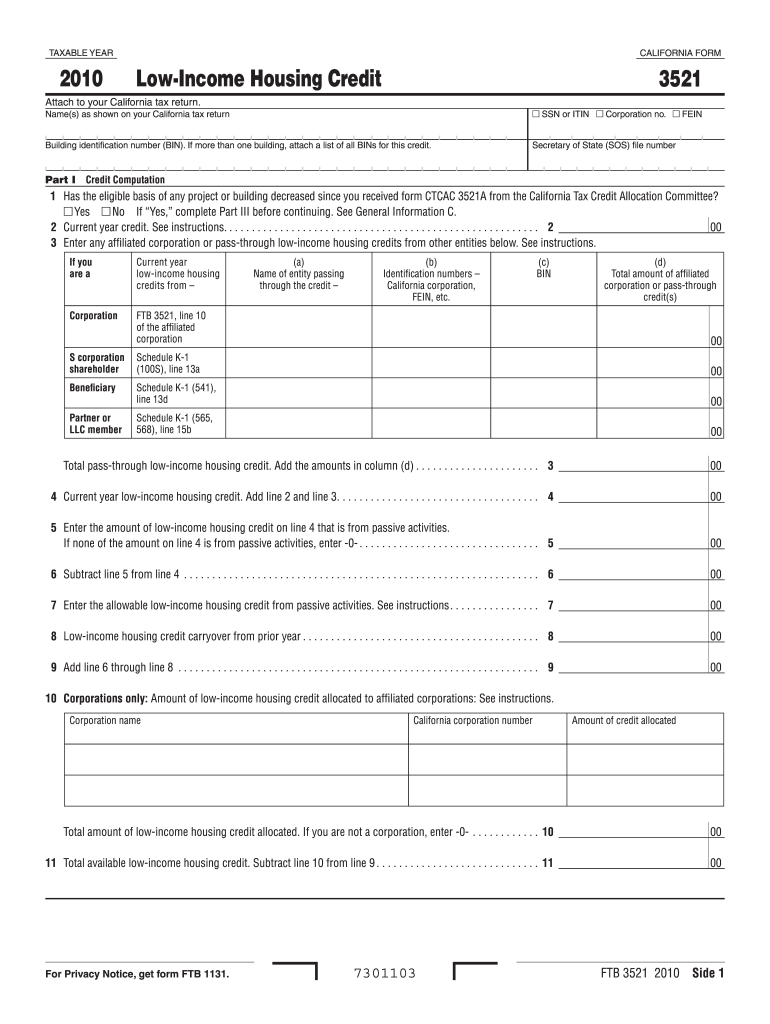

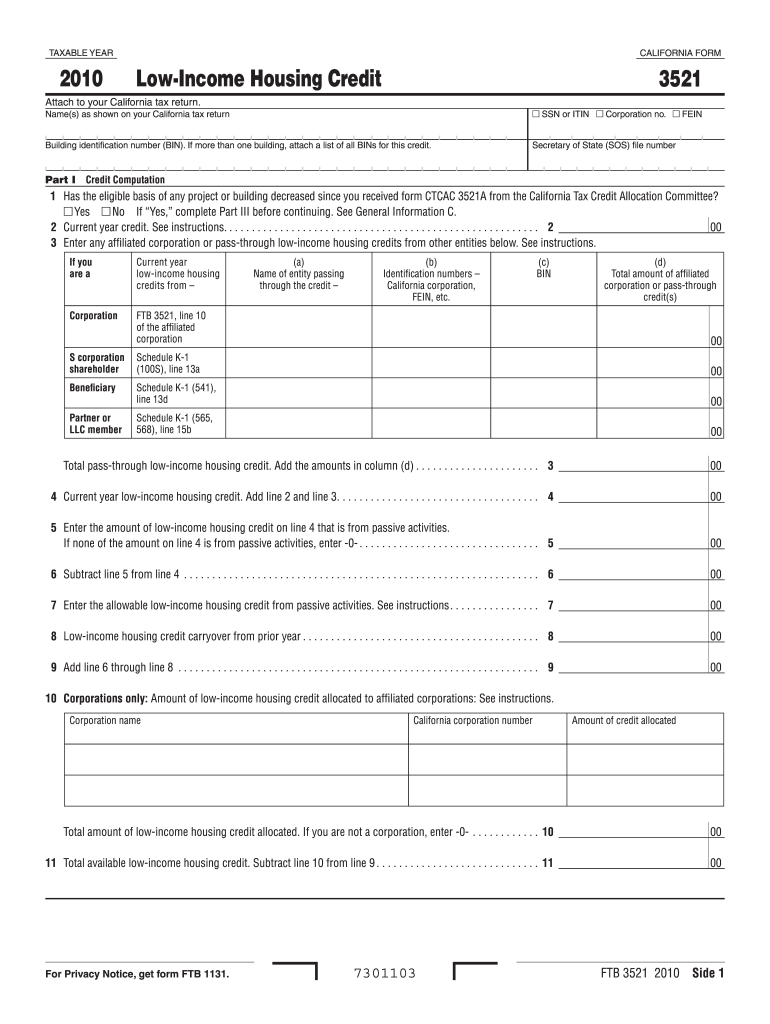

What information must be reported on form 3521?

Form 3521 is an information return used to report certain payments to foreign persons. It must include the name and address of the recipient, the type of payment, the amount of the payment, and any applicable withholding taxes. It must also include the name and address of the payer, the date of the payment, and the foreign country where the recipient resides.

When is the deadline to file form 3521 in 2023?

The deadline to file IRS Form 3521 for the 2023 tax year is April 15, 2024.

What is the penalty for the late filing of form 3521?

The penalty for filing Form 3521 late is a minimum of $10 for each month the form is late, up to a maximum of $50. The penalty is calculated on the unpaid taxes from the form.

Form 3521 is a United States Internal Revenue Service (IRS) document used to report certain foreign trusts with American beneficiaries. It is known as the Annual Return to Report Transactions with Foreign Trusts and Receipt of Certain Foreign Gifts. This form is filed by U.S. beneficiaries who receive distributions from foreign trusts or receive gifts from foreign individuals exceeding a specific threshold. It is used to ensure compliance with tax laws regarding foreign trusts and gifts.

Who is required to file form 3521?

Form 3521, also known as the Annual Return of Foreign Trust with a U.S. Owner (also referred to as the Foreign Grantor Trust Form), must be filed by U.S. persons who are considered owners of a foreign trust. U.S. persons include citizens or residents of the United States, domestic partnerships, domestic corporations, or estates or trusts created under U.S. law. This form is used to report transactions with foreign trusts, including distributions, and to determine the U.S. tax liability on any income generated by the trust.

How to fill out form 3521?

Form 3521, also known as the Annual Return of Withheld Federal Income Tax, is used to report withholding of federal income taxes on non-payroll payments. Here's how you can fill out this form:

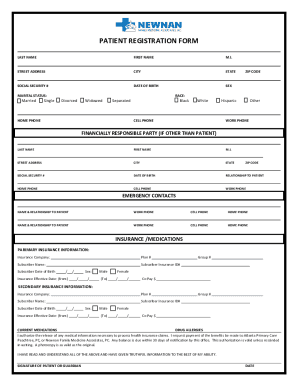

1. Provide the general information: Enter your name, address, and taxpayer identification number (TIN) in the appropriate fields at the top of the form.

2. Navigate to Section I: In this section, you will report the total amount of federal tax withheld from various non-payroll payments, such as backup withholding, gambling winnings, pensions, annuities, or real estate transactions. Enter the total amount withheld in the appropriate lines based on the type of income.

3. Move to Section II: Here, you will report withholding of federal income tax on non-payroll distributions or payments made to foreign persons. This includes the payment to foreign vendors, interest on deposits, etc. Enter the total amount withheld in the designated lines.

4. Go to Section III: In this section, you will report the total amount of backup withholding on reportable payments made to U.S. persons. This includes payments made for services, rents, attorney fees, etc. Enter the aggregate amount withheld in the appropriate lines.

5. Proceed to Section IV: If you made any payments to foreign vendors that are subject to withholding, you must complete this section. Provide the required details, including the total amount paid and the amount of federal tax withheld.

6. Complete Section V: In this section, you will report the total amount of backup withholding on business payments made to vendors or freelancers. Include any payments made for rent, services, or attorney fees. Enter the aggregate amount withheld in the specified lines.

7. Move to Section VI: If you made any payments for the acquisition of U.S. real property by a foreign person, you must complete this section. Provide the necessary information regarding the seller, buyer, property, and withholding amount.

8. Review and sign: Double-check all the information filled out in the form for accuracy. Sign and date the form, certifying that the information provided is true and correct.

Remember to keep a copy of the completed form for your records. It's also advisable to consult the instructions provided by the IRS for Form 3521 to ensure compliance with all requirements and to determine if any additional attachments are necessary.

What is the purpose of form 3521?

Form 3521, also known as the Annual Return of Withheld Federal Income Tax, is used by a withholding agent to report the amount of federal income tax withheld from non-resident aliens (NRAs) and foreign corporations. The purpose of this form is to provide the Internal Revenue Service (IRS) with information about the total amount of income tax withheld, enabling them to ensure compliance with U.S. tax laws. The form helps the IRS match the withholding information reported by the payer with the income tax return filed by the foreign recipient to ensure proper reporting and payment of taxes.

How do I complete form 3521 online?

pdfFiller makes it easy to finish and sign form 3521 online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How can I fill out form 3521 on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your form 3521 by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

Can I edit form 3521 on an Android device?

The pdfFiller app for Android allows you to edit PDF files like form 3521. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.